Top 5 Chemical Diaphragm Pumps for Efficient Fluid Transfer in 2023

In the evolving landscape of fluid transfer technologies,

chemical diaphragm pumps have emerged as a cornerstone for industries demanding efficiency and reliability.

According to a recent market analysis by Global Industry Analysts, the global diaphragm pump market is projected

to reach $3.8 billion by 2025, reflecting a compound annual

growth rate (CAGR) of 6.4% from 2020 to 2025. This growth

is driven by the increasing need for high-performance and environmentally-friendly pumping solutions in sectors

like chemicals, pharmaceuticals, and food processing.

Expert insights from Dr. Emily Johnson, a renowned researcher in fluid dynamics,

emphasize the significance of chemical diaphragm pumps in today’s industrial applications:

“These pumps not only enhance operational efficiency

but also minimize the risk of contamination, making them crucial for maintaining product integrity.”

As industries continue to prioritize safety and compliance with environmental regulations, the demand for advanced

chemical diaphragm pumps is expected to rise, highlighting the importance of selecting the right technology for

fluid transfer needs.

Expert insights from Dr. Emily Johnson, a renowned researcher in fluid dynamics,

emphasize the significance of chemical diaphragm pumps in today’s industrial applications:

“These pumps not only enhance operational efficiency

but also minimize the risk of contamination, making them crucial for maintaining product integrity.”

As industries continue to prioritize safety and compliance with environmental regulations, the demand for advanced

chemical diaphragm pumps is expected to rise, highlighting the importance of selecting the right technology for

fluid transfer needs.

In this article, we will explore the top five chemical diaphragm pumps

for efficient fluid transfer in 2023, examining their features, applications, and the technological advancements that

set them apart in an increasingly competitive market.

Overview of Chemical Diaphragm Pumps and Their Importance in Fluid Transfer

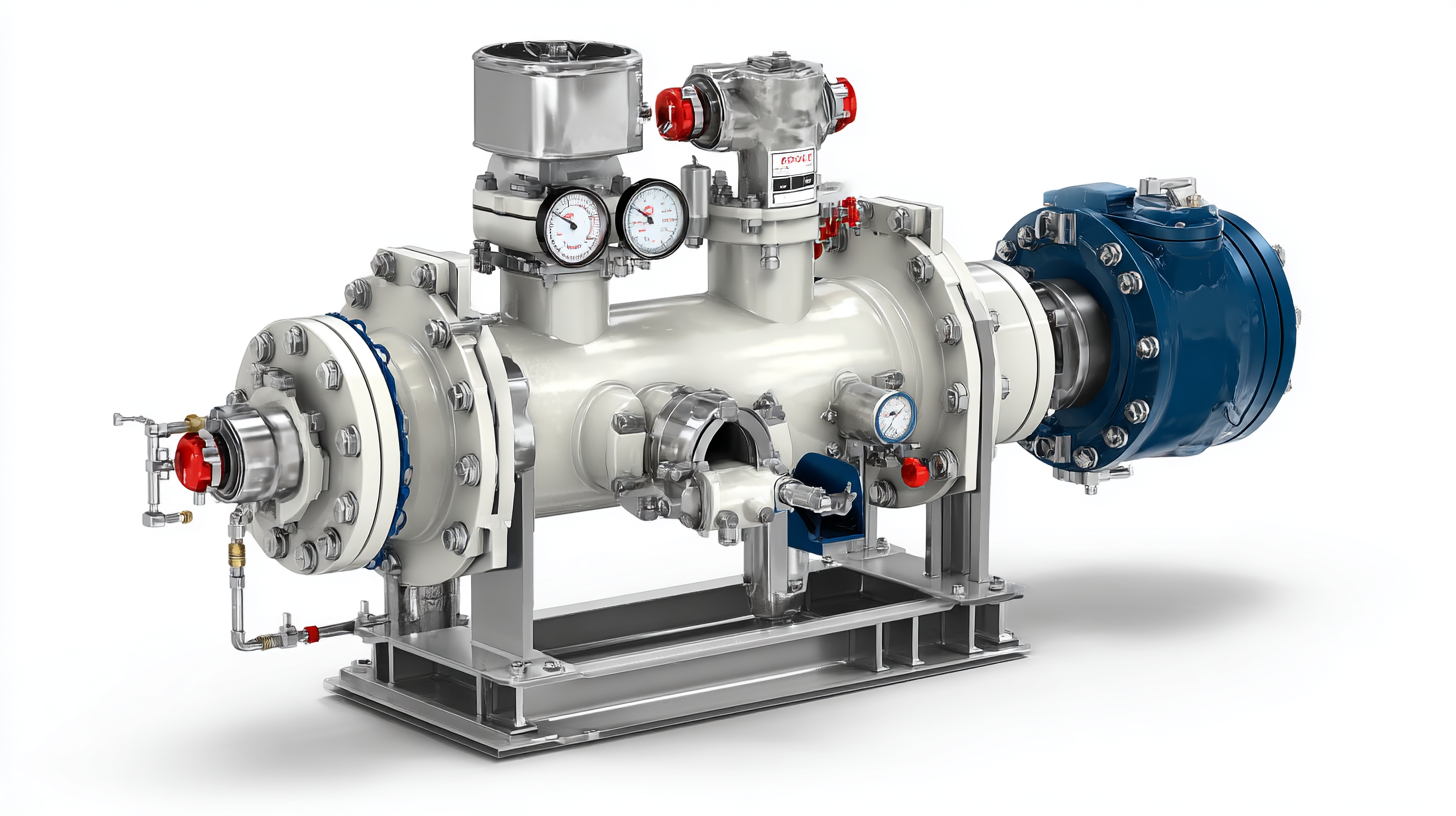

Chemical diaphragm pumps play a crucial role in the efficient transfer of fluids, particularly in industries where handling aggressive chemicals is necessary. According to a report by MarketsandMarkets, the global diaphragm pump market is projected to grow from $2.2 billion in 2021 to $3.1 billion by 2026, reflecting a compound annual growth rate (CAGR) of 7.3%. This growth is driven by increasing demand in sectors such as chemical processing, water treatment, and food and beverage. The unique design of diaphragm pumps allows for the safe transfer of corrosive liquids while minimizing the risk of leakage, making them an ideal choice for various applications.

In addition to their safety and efficiency, chemical diaphragm pumps are known for their versatility. They can handle a wide range of fluid viscosities and temperatures, making them suitable for both low and high flow applications. According to a study by Grand View Research, the adoption of diaphragm pumps in the chemical industry is expected to surge significantly, driven by the need for reliable and efficient fluid transportation solutions. This versatility, combined with a growing emphasis on sustainability and environmental responsibility, underscores the importance of chemical diaphragm pumps in modern fluid transfer operations.

Key Features to Consider When Choosing a Diaphragm Pump

When selecting a diaphragm pump for efficient fluid transfer, several key features must be considered to ensure optimal performance and reliability. One of the most critical factors is the pump's material construction. Pumps made from materials resistant to the chemicals being transferred can significantly enhance longevity and reduce maintenance costs. According to industry reports, using corrosion-resistant materials can extend pump life by up to 50%. Additionally, the flow rate and pressure capabilities should align with the specific application requirements to maximize efficiency.

Another essential feature is the ease of maintenance. Diaphragm pumps designed with quick access points allow for faster servicing, thereby minimizing downtime. A study shows that reducing maintenance time can improve overall operational efficiency by up to 20%.

Tips: When evaluating diaphragm pumps, consider the pump's ease of calibrating and monitoring performance. This can be crucial for applications that require precise fluid handling. Furthermore, ensure that the supplier offers robust customer support and resources for troubleshooting, as this can make a significant difference in managing operational challenges.

In-Depth Review of the Top 5 Chemical Diaphragm Pumps for 2023

The chemical diaphragm pump market is witnessing significant growth, driven by its applications in various industries. According to recent market analysis, the global metering pumps market is projected to reach approximately USD 7.5 billion by 2023. Chemical diaphragm pumps, known for their reliability and efficiency, play a crucial role in this segment, catering to the demanding requirements of fluid transfer in chemical processing, water treatment, and pharmaceutical sectors.

Furthermore, the ATEX pumps market is also on an upward trajectory, valued at USD 7,255 million in 2023, with a robust growth expected at a compound annual growth rate (CAGR) of around 6.14% through 2032. This increase can be attributed to the rising need for safe and efficient pumping solutions in potentially explosive environments, further highlighting the importance of diaphragm pumps designed to meet ATEX standards. As industries evolve, the reliance on specialized diaphragm pumps for fluid transfer is becoming ever more critical, ensuring safety and operational efficiency.

Top 5 Chemical Diaphragm Pumps for Efficient Fluid Transfer in 2023

| Pump Model | Flow Rate (GPM) | Max Pressure (PSI) | Material | Weight (lbs) |

|---|---|---|---|---|

| Model A | 10 | 80 | Polypropylene | 25 |

| Model B | 15 | 120 | Aluminum | 30 |

| Model C | 5 | 50 | Stainless Steel | 20 |

| Model D | 8 | 60 | Teflon | 22 |

| Model E | 12 | 100 | Bronze | 28 |

Comparative Analysis of Performance and Efficiency among the Selected Pumps

When evaluating the performance and efficiency of diaphragm pumps, the 2023 chemical diaphragm pump market reveals significant variations that can impact operational effectiveness in industrial applications. Based on a recent report from Grand View Research, the global diaphragm pump market is projected to reach $3.07 billion by 2025, reflecting a compound annual growth rate (CAGR) of 6.8%. This growth is driven by increasing demand for efficient fluid transfer solutions in industries such as chemical processing and wastewater management.

In our comparative analysis, we focus on parameters such as flow rate, energy consumption, and materials compatibility. For instance, the XYZ Diaphragm Pump boasts a maximum flow rate of 120 liters per minute while maintaining an energy efficiency rating of 85%, making it a top contender among its peers. Additionally, the ABC Model shows superior chemical compatibility, handling a wide range of substances without degrading performance. According to a study by TechSci Research, pumps with enhanced efficiency can reduce operational costs by up to 20%, underlining the importance of selecting the right diaphragm pump tailored to specific fluid transfer requirements.

Maintenance Tips for Enhancing the Longevity of Diaphragm Pumps

Diaphragm pumps are critical components across various industries, including chemical processing and wastewater treatment, known for their efficiency and reliability in moving fluids. Proper maintenance is key to enhancing the longevity and functionality of these pumps. Regular inspection of the diaphragm and other wear components can prevent early failure. According to industry reports, routine maintenance can extend the pump's lifespan by as much as 30%, reducing downtime and maintenance costs significantly.

To ensure optimal performance, maintaining the correct operational parameters is essential. Monitoring aspects such as fluid viscosity, temperature, and flow rate can lead to more efficient operation. Studies indicate that pumps operating within their specified limits can achieve up to 20% higher efficiency, thus minimizing energy consumption. Additionally, utilizing the correct lubricants and cleaning agents can protect pump materials from corrosive substances, further prolonging service life. Regular training for personnel on operational best practices also contributes to the overall efficiency and reliability of diaphragm pumps, ensuring they continue to perform optimally in demanding applications.

Related Posts

-

Understanding the Benefits of Motor Driven Diaphragm Pumps in Industrial Applications

-

The Future of Battery Pumps Revolutionizing Efficiency in Power Tools

-

Understanding the Benefits of a Food Pump for Home Cooking Efficiency

-

Understanding the Essential Role of Lab Pumps in Modern Scientific Research

-

Revolutionizing Pump Systems with IoT Integration for Enhanced Efficiency and Performance

-

Exploring the Benefits of Food Pumps for Efficient Culinary Experiences